Seamless View is our solution for a payment

experience that is integrated directly on your website.

The payment process will be executed in an iframe on

your page.

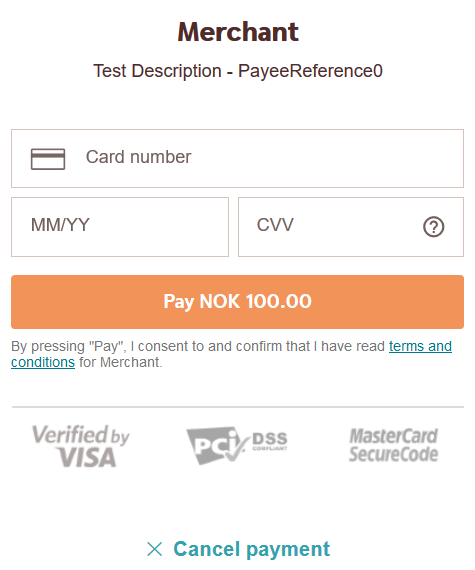

Redirect will take the payer to a Swedbank Pay hosted payment page where they can perform a safe transaction. The payer will be redirected back to your website after the completion of the payment.

- When properly set up in your merchant/webshop site and the payer starts the

purchase process, you need to make a

POSTrequest towards Swedbank Pay with your Purchase information. This will generate a payment object with a uniquepaymentID. You either receive a Redirect URL to a Swedbank Pay hosted page (Redirect integration) or a JavaScript source in response (Seamless View integration). - You need to redirect the payer’s browser to that specified URL,

or embed the script source on your site to create a Seamless View in an

iframe; so that the payer can enter the credit card details in a secure Swedbank Pay hosted environment. - Swedbank Pay will handle 3-D Secure authentication when this is required.

- Swedbank Pay will redirect the payer’s browser to - or display directly in

the

iframe- one of two specified URLs, depending on whether the payment session is followed through completely or cancelled beforehand. Please note that both a successful and rejected payment reach completion, in contrast to a cancelled payment. - When you detect that the payer reach your

completeUrl, you need to do aGETrequest, containing theidof the payment generated in the first step, to receive the state of the transaction.

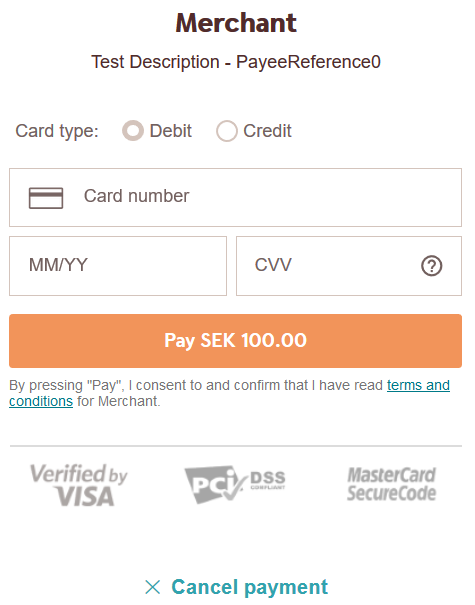

You will redirect the payer to Swedbank Pay hosted pages to collect the credit card information.

When shopping in SEK, the page will look like this.

Operations

The API requests are displayed in the purchase flow.

You can create a card payment with following operation

options:

Our payment example below uses the Purchase operation.

Intent

Intent

The intent of the payment identifies how and when the charge will be effectuated. This determines the type of transaction used during the payment process.

-

AutoCapture(one-phase): If you want the card to be charged (without additional operations), you will have to specify that theintentof thePurchaseisAutoCapture. This is normally only allowed if the payer purchases digital products with instant delivery/shipment. Check with your acquirer before using this feature. The amount will be reserved via the authorization and the credit card will be charged automatically. You don’t need to do any more financial operations to fulfill the transaction.

This payment method supports Danish da-DK, German de-DE, Estonian

ee-EE, English (US) en-US, Spanish es-ES, Finnish fi-FI, French fr-FR,

Lithuanian lt-LT, Latvian lv-LV, Norwegian nb-NO, Russian ru-RU and

Swedish sv-SE.

Sequence Diagram

The sequence diagram below shows a high level description of a complete purchase, and the requests you have to send to Swedbank Pay. The links will take you directly to the corresponding API description.

When dealing with card payments, 3-D Secure authentication of the cardholder is an essential topic. By default, 3-D Secure should be enabled. Depending on the card issuer, Swedbank Pay will check if the card is enrolled with 3-D Secure. This process has two alternative outcomes:

- If the card is enrolled with 3-D Secure, Swedbank Pay will redirect the cardholder to the authentication mechanism that is decided by the issuing bank. Normally this will be done using BankID or Mobile BankID.

- If the card is not enrolled with 3-D Secure, no authentication of the cardholder is done.

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

activate Payer

Payer->>-Merchant: start purchase

activate Merchant

Merchant->>-SwedbankPay: POST /psp/creditcard/payments

activate SwedbankPay

note left of Merchant: First API Request

SwedbankPay-->>-Merchant: payment resource

activate Merchant

Merchant-->>-Payer: authorization page

activate Payer

note left of Payer: redirect to SwedbankPay<br>(If Redirect scenario)

Payer->>-Merchant: access merchant page

activate Merchant

Merchant->>-SwedbankPay: GET <payment.id>

activate SwedbankPay

note left of Merchant: Second API request

SwedbankPay-->>-Merchant: rel: redirect-authorization

activate Merchant

Merchant-->>-Payer: display purchase result

activate Payer

sequenceDiagram

participant Payer

participant Merchant

participant SwedbankPay as Swedbank Pay

activate Payer

Payer->>-Merchant: start purchase

activate Merchant

Merchant->>-SwedbankPay: POST /psp/creditcard/payments

activate SwedbankPay

note left of Payer: First API request

SwedbankPay-->>-Merchant: payment resource

activate Merchant

Merchant-->>-Payer: authorization page

activate Payer

Payer->>-SwedbankPay: access authorization page

activate SwedbankPay

note left of Payer: redirect to SwedbankPay<br>(If Redirect scenario)

SwedbankPay-->>-Payer: display purchase information

activate Payer

Payer->>Payer: input creditcard information

Payer->>-SwedbankPay: submit creditcard information

activate SwedbankPay

opt Card supports 3-D Secure

SwedbankPay-->>-Payer: redirect to IssuingBank

activate Payer

Payer->>IssuingBank: 3-D Secure authentication process

activate IssuingBank

Payer->>-SwedbankPay: access authentication page

end

SwedbankPay-->>-Payer: redirect to merchant

activate Payer

note left of Payer: redirect back to merchant<br>(If Redirect scenario)

Payer->>-Merchant: access merchant page

activate Merchant

Merchant->>-SwedbankPay: GET <payment.id>

activate SwedbankPay

note left of Merchant: Second API request

SwedbankPay-->>-Merchant: rel: redirect-authorization

activate Merchant

Merchant-->>-Payer: display purchase result

opt Callback is set

activate SwedbankPay

SwedbankPay->>SwedbankPay: Payment is updated

SwedbankPay->>-Merchant: POST Payment Callback

end