Step 3: Create Payment Order

Once the consumer has been identified, the next step is to initiate the payment

using consumerProfileRef retrieved in the previous step.

We start by performing a POST request towards the paymentorder resource

with the payer information (such as consumerProfileRef) we obtained in the

checkin process described above. This information will appear prefilled in the

Payment Menu.

If you are sending a guest user POST request, simply leave out the

consumerProfileRef from the input, and the payer will be sent to an empty

Payment Menu. Information like email, address and msisdn can still be

added manually in the payer field. If added, it will appear prefilled in the

Payment Menu.

Remember to read up on our URL resource.

To minimize the risk for

a challenge request (Strong Customer Authentication – “SCA”) on card payments,

it’s recommended that you add as much data as possible to the riskIndicator

object in the request below.

GDPR: GDPR

sensitive data such as email, phone numbers and social security numbers must

not be used directly in request fields such as payerReference. If it is

necessary to use GDPR sensitive data, it must be hashed and then the hash can be

used in requests towards Swedbank Pay.

Payment Url

For our Seamless Views, the field called paymentUrl will be used when the

payer is redirected out of the Seamless View (the iframe). The payer is

redirected out of frame when selecting payment methods which trigger SCA.

This includes 3-D Secure card payments, installment account, invoice, MobilePay,

monthly invoice payments, Trustly and Vipps.

The URL should represent the page of where the Payment Order Seamless View was

hosted originally, such as the checkout page, shopping cart page, or similar.

Basically, paymentUrl should be set to the same URL as that of the page where

the JavaScript for the Seamless View was added to in order to initiate the

payment process.

Please note that the paymentUrl must be able to invoke the same JavaScript URL

from the same Payment Order as the one that initiated the payment process

originally, so it should include some sort of state identifier in the URL. The

state identifier is the ID of the order, shopping cart or similar that has the

URL of the Payment stored.

With paymentUrl in place, the retry process becomes much more convenient for

both the integration and the payer.

Payment Order Request

Request

1

2

3

4

POST /psp/paymentorders HTTP/1.1

Host: api.externalintegration.payex.com

Authorization: Bearer <AccessToken>

Content-Type: application/json;version=3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

{

"paymentorder": {

"operation": "Purchase",

"currency": "SEK",

"amount": 1500,

"vatAmount": 375,

"description": "Test Purchase",

"userAgent": "Mozilla/5.0...",

"language": "sv-SE",

"generateRecurrenceToken": false,

"generateUnscheduledToken": false,

"urls": {

"hostUrls": [ "https://example.com", "https://example.net" ],

"completeUrl": "https://example.com/payment-completed",

"cancelUrl": "https://example.com/payment-cancelled",

"paymentUrl": "https://example.com/perform-payment",

"callbackUrl": "https://api.example.com/payment-callback",

"termsOfServiceUrl": "https://example.com/termsandconditions.pdf",

"logoUrl": "https://example.com/logo.png"

},

"payeeInfo": {

"payeeId": "5cabf558-5283-482f-b252-4d58e06f6f3b",

"payeeReference": "AB832",

"payeeName": "Merchant1",

"productCategory": "A123",

"orderReference": "or-123456",

"subsite": "MySubsite"

},

"payer": {

"consumerProfileRef": "5a17c24e-d459-4567-bbad-aa0f17a76119"

},

"orderItems": [

{

"reference": "P1",

"name": "Product1",

"type": "PRODUCT",

"class": "ProductGroup1",

"itemUrl": "https://example.com/products/123",

"imageUrl": "https://example.com/product123.jpg",

"description": "Product 1 description",

"discountDescription": "Volume discount",

"quantity": 5,

"quantityUnit": "pcs",

"unitPrice": 300,

"discountPrice": 0,

"vatPercent": 2500,

"amount": 1500,

"vatAmount": 375

}

],

"riskIndicator": {

"deliveryEmailAddress": "olivia.nyhuus@swedbankpay.com",

"deliveryTimeFrameIndicator": "01",

"preOrderDate": "19801231",

"preOrderPurchaseIndicator": "01",

"shipIndicator": "01",

"giftCardPurchase": false,

"reOrderPurchaseIndicator": "01",

"pickUpAddress": {

"name": "Olivia Nyhus",

"streetAddress": "Saltnestoppen 43",

"coAddress": "",

"city": "Saltnes",

"zipCode": "1642",

"countryCode": "NO"

}

}

}

}

paymentOrder

object

check

operation

string

check

Determines the initial operation, defining the type of payment order created. Possible options are Purchase, Abort Verify, UnscheduledPurchase, Recur and Payout.

currency

string

check

amount

integer

check

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

check

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string

check

generateRecurrenceToken

bool

false.

generateUnscheduledToken

bool

false.

userAgent

string

check

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser.

language

string

check

urls

object

check

urls object, containing the URLs relevant for the payment order.

hostUrls

array

check

completeUrl

string

check

The URL that Swedbank Pay will redirect back to when the payer has completed their interactions with the payment. This does not indicate a successful payment, only that it has reached a final (complete) state. A GET request needs to be performed on the payment order to inspect it further. See completeUrl for details.

cancelUrl

string

abort request of the payment or paymentorder.

paymentUrl

string

The paymentUrl represents the URL that Swedbank Pay will redirect back to when the view-operation needs to be loaded, to inspect and act on the current status of the payment, such as when the payer is redirected out of the Seamless View (the <iframe>) and sent back after completing the payment. paymentUrl is only used in Seamless Views and should point to the page of where the Payment Order Seamless View is hosted. If both cancelUrl and paymentUrl is sent, the paymentUrl will used. Trustly will only be available if the paymentUrl is provided while using Seamless View. When using Redirect, Trustly will appear regardless.

callbackUrl

string

The URL that Swedbank Pay will perform an HTTP POST against every time a transaction is created on the payment order. See callback for details.

termsOfServiceUrl

string

check

The URL to the terms of service document which the payer must accept in order to complete the payment. HTTPS is a requirement.

logoUrl

string

check

With permission and activation on your contract (if you are using Seamless View), sending in a logoUrl will replace the Swedbank Pay logo with the logo sent in. If you do not send in a logoUrl, then no logo and no text is shown. Without permission or activation on your contract, sending in a logoUrl has no effect. The logo must be a picture with maximum 50px height and 400px width. Requires HTTPS. Read more about this in Custom Logo .

payeeInfo

object

check

The payeeInfo object, containing information about the payee (the recipient of the money). See payeeInfo for details.

payeeId

string

check

payeeReference

string(30)

check

A unique reference from the merchant system. Set per operation to ensure an exactly-once delivery of a transactional operation. Length and content validation depends on whether the transaction.number or the payeeReference is sent to the acquirer. If Swedbank Pay handles the settlement, the transaction.number is sent to the acquirer and the payeeReference must be in the format of A-Za-z0-9 and string(30). If you handle the settlement, Swedbank Pay will send the payeeReference and it will be limited to the format of string(12). All characters must be digits. In Invoice Payments payeeReference is used as an invoice/receipt number, if the receiptReference is not defined.

payeeName

string

productCategory

string(50)

orderReference

string(50)

subsite

string(40)

The subsite field can be used to perform a split settlement on the payment. The different subsite values must be resolved with Swedbank Pay reconciliation before being used. If you send in an unknown subsite value, it will be ignored and the payment will be settled using the merchant’s default settlement account. Must be in the format of A-Za-z0-9.

payer

object

payer object containing information about the payer relevant for the payment order.

consumerProfileRef

string

email

string

msisdn

string

workPhoneNumber

string

homePhoneNumber

string

orderItems

array

check

The array of items being purchased with the order. Note that authorization orderItems will not be printed on invoices, so lines meant for print must be added in the Capture request. The authorization orderItems will, however, be used in the Merchant Portal when captures or reversals are performed, and might be shown other places later. It is required to use this field to be able to send Capture orderItems. Capture requests should only contain items meant to be captured from the order.

reference

string

check

name

string

check

type

string

check

PRODUCT, SERVICE, SHIPPING_FEE, PAYMENT_FEE DISCOUNT, VALUE_CODE or OTHER. The type of the order item. PAYMENT_FEE is the amount you are charged with when you are paying with invoice. The amount can be defined in the amount field below.

class

string

check

MobilePhone. Note that class cannot contain spaces and must follow the regex pattern [\w-]*. Swedbank Pay may use this field for statistics.

itemUrl

string

imageUrl

string

description

string

A textual description of the purchase. Maximum length is 40 characters.

discountDescription

string

quantity

number

check

quantityUnit

string

check

pcs, grams, or similar. This is used for your own book keeping.

unitPrice

integer

check

discountPrice

integer

vatPercent

integer

check

25% becomes 2500.

amount

integer

check

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

check

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

riskIndicator

array

deliveryEmailAdress

string

deliveryTimeFrameIndicator

string

`01` (Electronic Delivery)

`02` (Same day shipping)

`03` (Overnight shipping)

`04` (Two-day or more shipping)

preOrderDate

string

preOrderPurchaseIndicator

string

`01` (Merchandise available)

`02` (Future availability)

shipIndicator

string

`01` (Ship to cardholder's billing address)

`02` (Ship to another verified address on file with merchant)

`03` (Ship to address that is different than cardholder's billing address)

`04` (Ship to Store / Pick-up at local store. Store address shall be populated in shipping address fields)

`05` (Digital goods, includes online services, electronic giftcards and redemption codes)

`06` (Travel and Event tickets, not shipped)

`07` (Other, e.g. gaming, digital service)

giftCardPurchase

bool

reOrderPurchaseIndicator

string

`01` (First time ordered)

`02` (Reordered).

pickUpAddress

object

name

string

streetAddress

string

coAddress

string

city

string

zipCode

string

countryCode

string

Payment Order Response

Response

1

2

3

HTTP/1.1 200 OK

Content-Type: application/json; charset=utf-8; version=3.x/2.0

api-supported-versions: 3.x/2.0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

{

"paymentorder": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce",

"recurrenceToken": 2c327f17-1818-425a-9657-5d7d69778b31,

"unscheduledToken": 064c3cbd-9401-4356-aba2-92cc3484313b,

"created": "2020-06-22T10:56:56.2927632Z",

"updated": "2020-06-22T10:56:56.4035291Z",

"operation": "Purchase",

"state": "Ready",

"currency": "SEK",

"amount": 10000,

"vatAmount": 0,

"orderItems": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce/orderitems"

},

"description": "test description",

"initiatingSystemUserAgent": "swedbankpay-sdk-dotnet/3.0.1",

"userAgent": "Mozilla/5.0",

"language": "sv-SE",

"urls": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce/urls"

},

"payeeInfo": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce/payeeInfo"

},

"payments": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce/payments"

},

"currentPayment": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce/currentpayment"

},

"items": [

{

"creditCard": {

"cardBrands": [

"Visa",

"MasterCard"

]

}

}

]

}

"operations": [

{

"method": "PATCH",

"href": "https://ecom.externalintegration.payex.com/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce",

"rel": "update-paymentorder-updateorder",

"contentType": "application/json"

},

{

"method": "PATCH",

"href": "https://api.externalintegration.payex.com/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce",

"rel": "update-paymentorder-abort",

"contentType": "application/json"

},

{

"method": "PATCH",

"href": "https://ecom.externalintegration.payex.com/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce",

"rel": "update-paymentorder-expandinstrument",

"contentType": "application/json"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/paymentmenu/5a17c24e-d459-4567-bbad-aa0f17a76119?_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "redirect-paymentorder",

"contentType": "text/html"

},

{

"method": "GET",

"href": "https://ecom.externalintegration.payex.com/paymentmenu/core/scripts/client/px.paymentmenu.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119&culture=nb-NO&_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "view-paymentorder",

"contentType": "application/javascript"

}

]

}

paymentOrder

object

id

string

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution.

instrument

string

paymentToken

string

generatePaymentToken: true was used. Enables future one-click payments – with the same token.

recurrenceToken

string

generateRecurrenceToken: true was used. Enables future recurring payments – with the same token.

unscheduledToken

string

generateUnscheduledToken: true was used. Enables future unscheduled payments – with the same token.

created

date(string)

updated

date(string)

operation

string

Purchase

state

string

Ready, Pending, Failed or Aborted. Indicates the state of the payment order. Does not reflect the state of any ongoing payments initiated from the payment order. This field is only for status display purposes.

currency

enum(string)

DKK, EUR, NOK or SEK). Some payment methods are only available with selected currencies.

amount

integer

The transaction amount (including VAT, if any) entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK.

vatAmount

integer

The payment’s VAT (Value Added Tax) amount, entered in the lowest monetary unit of the selected currency. E.g.: 10000 = 100.00 SEK, 5000 = 50.00 SEK. The vatAmount entered will not affect the amount shown on the payment page, which only shows the total amount. This field is used to specify how much of the total amount the VAT will be. Set to 0 (zero) if there is no VAT amount charged.

description

string(40)

A textual description of the purchase. Maximum length is 40 characters.

userAgent

string

The user agent of the payer. Should typically be set to the value of the User-Agent header sent by the payer’s web browser.

language

string

Allowed locale code values: da-DK, de-DE, et-EE, en-US, es-ES, fi-FI, fr-FR, lt-LT, lv-LV, nb-NO, pl-PL, ru-RU, or sv-SE.

urls

id

urls resource where all URLs related to the payment order can be retrieved.

payeeInfo

id

payeeInfo resource where information related to the payee can be retrieved.

payers

id

payer resource where information about the payer can be retrieved.

orderItems

id

orderItems resource where information about the order items can be retrieved.

metadata

id

metadata resource where information about the metadata can be retrieved.

payments

id

payments resource where information about all underlying payments can be retrieved.

currentPayment

id

currentPayment resource where information about the current – and sole active – payment can be retrieved.

operations

array

The array of operations that are possible to perform on the payment order in its current state.

Response

The response back should include this (abbreviated for brevity):

Response

1

2

HTTP/1.1 201 Created

Content-Type: application/json

1

2

3

4

5

6

7

8

9

10

11

12

13

{

"paymentorder": {

"id": "/psp/paymentorders/09ccd29a-7c4f-4752-9396-12100cbfecce"

},

"operations": [

{

"href": "https://ecom.externalintegration.payex.com/paymentmenu/core/scripts/client/px.paymentmenu.client.js?token=5a17c24e-d459-4567-bbad-aa0f17a76119&culture=sv-SE&_tc_tid=30f2168171e142d38bcd4af2c3721959",

"rel": "view-paymentorder",

"method": "GET",

"contentType": "application/javascript"

}

]

}

| Field | Type | Description |

|---|---|---|

paymentOrder |

object |

The payment order object. |

id |

string |

The relative URL and unique identifier of the paymentorder resource . Please read about URL Usage to understand how this and other URLs should be used in your solution. |

operations |

array |

The array of operations that are possible to perform on the payment order in its current state. |

The paymentorder object is abbreviated since it’s just the id and

operations we are interested in. Store the id of the Payment Order

in your system to look up status on the completed payment later.

Then find the view-paymentorder operation and embed its href in a

<script> element.

That script will then load the Seamless View for the Payment Menu. We will look

into how to hook that up next.

Please note that nested iframes (an iframe within an iframe) are unsupported.

orderReference must

be sent as a part of the POST request to paymentorders and must represent

the order ID of the webshop or merchant website.

Step 4: Display the Payment Menu

To load the Payment Menu from the JavaScript URL obtained in the back end API

response, it needs to be set as a script element’s src attribute. You can

cause a page reload and do this with static HTML, or you can avoid the page

refresh by invoking the POST to create the payment order through Ajax and then

create the script element with JavaScript, all inside the event handler for

onConsumerIdentified.

The HTML code will be unchanged in this example.

For the guest Payment Menu, lines 23-44 in the JavaScript should be your main focus. They contain what you need to display the Payment Menu without Checkin.

JavaScript

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

var request = new XMLHttpRequest();

request.addEventListener('load', function () {

// We will assume that our own backend returns the

// exact same as what SwedbankPay returns.

response = JSON.parse(this.responseText);

var script = document.createElement('script');

// This assumes the operations from the response of the POST of the

// payment order is returned verbatim from the server to the Ajax:

var operation = response.operations.find(function (o) {

return o.rel === 'view-consumer-identification';

});

script.setAttribute('src', operation.href);

script.onload = function () {

payex.hostedView.consumer({

// The container specifies which id the script will look for

// to host the checkin component

container: 'checkin',

onConsumerIdentified: function onConsumerIdentified(consumerIdentifiedEvent) {

// When the consumer is identified, we need to perform an AJAX request

// to our server to forward the consumerProfileRef in a server-to-server

// POST request to the Payment Orders resource in order to initialize

// the Payment Menu.

var request = new XMLHttpRequest();

request.addEventListener('load', function () {

response = JSON.parse(this.responseText);

// This is identical to how we get the 'view-consumer-identification'

// script from the check-in.

var script = document.createElement('script');

var operation = response.operations.find(function (o) {

return o.rel === 'view-paymentorder';

});

script.setAttribute('src', operation.href);

script.onload = function () {

// When the 'view-paymentorder' script is loaded, we can initialize the

// Payment Menu inside our 'payment-menu' container.

payex.hostedView.paymentMenu({

container: 'payment-menu',

culture: 'sv-SE'

}).open();

};

// Append the Payment Menu script to the <head>

var head = document.getElementsByTagName('head')[0];

head.appendChild(script);

});

// Like before, you should replace the address here with

// your own endpoint.

request.open('POST', '<Your-Backend-Endpoint-Here>', true);

request.setRequestHeader('Content-Type', 'application/json; charset=utf-8');

// In this example, we send the entire Consumer Identified Event Argument

// Object as JSON to the server, as it contains the consumerProfileRef.

request.send(JSON.stringify(consumerIdentifiedEvent));

},

onShippingDetailsAvailable: function onShippingDetailsAvailable(shippingDetailsAvailableEvent) {

console.log(shippingDetailsAvailableEvent);

}

}).open();

};

// Appending the script to the head

var head = document.getElementsByTagName('head')[0];

head.appendChild(script);

});

// Place in your own API endpoint here.

request.open('POST', '<Your-Backend-Endpoint-Here>', true);

request.setRequestHeader('Content-Type', 'application/json; charset=utf-8');

// We send in the previously mentioned request here to the checkin endpoint.

request.send(JSON.stringify({

operation: 'initiate-consumer-session',

language: 'sv-SE',

shippingAddressRestrictedToCountryCodes : ['NO', 'SE']

}));

Monitoring The Script URL

If you choose to stay with Seamless View, please take the following under advisement.

To ensure compliance, we recommend implementing Content Security Policy rules to monitor and authorize scripts.

Merchants must whitelist the following domains to restrict browser content retrieval to approved sources. While https://.payex.com and https://.swedbankpay.com cover most payment methods, digital wallets such as Apple Pay, Click to Pay, and Google Pay are delivered via Payair. Alongside the Payair URL, these wallets may also generate URLs from Apple, Google, MasterCard, and Visa. See the table below for more information.

When it comes to ACS URLs, nothing is loaded from the ACS domain in the merchant’s end. It will either happen within Swedbank Pay’s domain or as a redirect, which will repeal the merchant’s CSP.

The list below includes important URLs, but may not be exhaustive. Merchants need to stay up to date in case of URL changes, or if you need to whitelist URLs not listed here.

For further details, refer to section 4.6.3 and 11.6.1 in this PCI-DSS document.

| URL | Description |

|---|---|

| https://*.cdn-apple.com | URL needed for Apple Pay. |

| https://*.google.com | URL needed for Google Pay. |

| https://*.gstatic.com | Domain used by Google that hosts images, CSS, and javascript code to reduce bandwidth usage online. |

| https://*.mastercard.com | URL needed for Click to Pay. |

| https://*.payair.com | URL for the digital wallets Apple Pay, Click to Pay and Google Pay. |

| https://*.payex.com | Universal URL for all payment methods except the digital wallets Apple Pay, Click to Pay and Google Pay. |

| https://*.swedbankpay.com | Universal URL for all payment methods except the digital wallets Apple Pay, Click to Pay and Google Pay. |

| https://*.visa.com | URL needed for Click to Pay. |

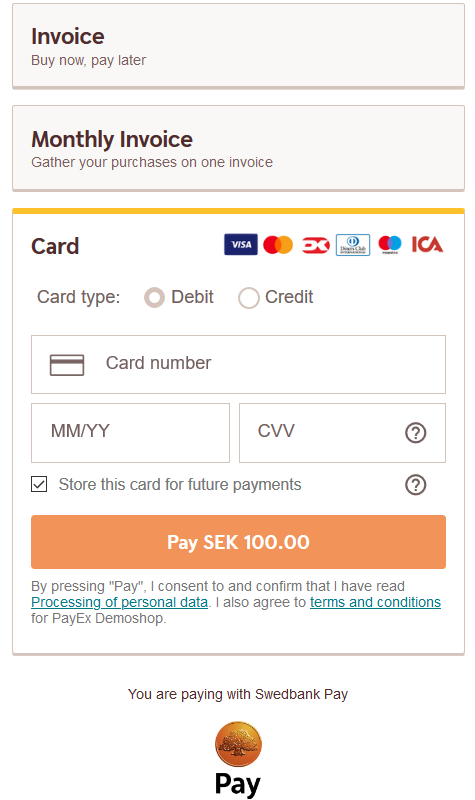

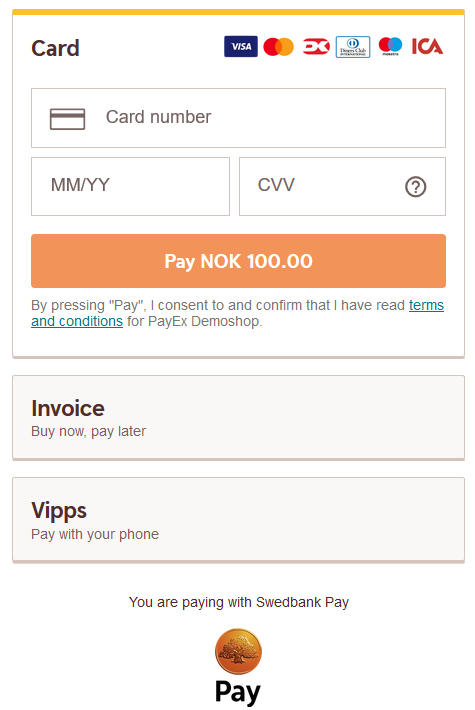

How Seamless View Looks

This should bring up the Payment Menu in a Seamless View looking like this, depending on whether the payer is logged in (top) or a guest user (bottom). Payments done in SEK will have radio buttons for choosing debit or credit card.

When the the payment is completed, the Payment Menu script will be signaled and

a full redirect to the completeUrl sent in with the Payment Order will be

performed. When the completeUrl on your server is hit, you can inspect the

status on the stored paymentorder.id on the server, and then perform

capture.

Authorizations are kept valid in our systems for 180 days, and we accept captures within this timeframe. Please be aware that acquirers might have a shorter time limit before authorized amounts are released in their systems. We advise you to check with your acquirer if you have concerns about these limits.

If the payment is a Sale or one-phase purchase, it will be

automatically captured. A third scenario is if the goods are sent physically to

the payer; then you should await capture until after the goods have been sent.

You may open and close the payment menu using .open() and .close()

functions. You can also invoke .refresh() to

update the Payment Menu after any changes to the

order.

Below, you will see a complete overview of the payment menu process. Notice that there are two ways of performing the payment:

- Consumer perform payment out of

iframe. - Consumer perform payment within

iframe.

sequenceDiagram

participant Consumer

participant Merchant

participant SwedbankPay as Swedbank Pay

rect rgba(138, 205, 195, 0.1)

activate Consumer

note left of Consumer: Payment Menu

Consumer ->>+ Merchant: Initiate Purchase

deactivate Consumer

Merchant ->>+ SwedbankPay: POST /psp/paymentorders (paymentUrl, payer)

deactivate Merchant

SwedbankPay -->>+ Merchant: rel:view-paymentorder

deactivate SwedbankPay

Merchant -->>- Consumer: Display Payment Menu on Merchant Page

activate Consumer

Consumer ->> Consumer: Initiate Payment Menu Seamless View (open iframe)

Consumer -->>+ SwedbankPay: Show Payment UI page in iframe

deactivate Consumer

SwedbankPay ->>+ Consumer: Do payment logic

deactivate SwedbankPay

opt Consumer perform payment out of iFrame

Consumer ->> Consumer: Redirect to 3rd party

Consumer ->>+ 3rdParty: Redirect to 3rdPartyUrl URL

deactivate Consumer

3rdParty -->>+ Consumer: Redirect back to paymentUrl (merchant)

deactivate 3rdParty

Consumer ->> Consumer: Initiate Payment Menu Seamless View (open iframe)

Consumer ->>+ SwedbankPay: Show Payment UI page in iframe

deactivate Consumer

SwedbankPay ->> Consumer: Do payment logic

end

SwedbankPay -->> Consumer: Payment status

deactivate SwedbankPay

alt If payment is completed

activate Consumer

Consumer ->> Consumer: Event: onPaymentCompleted

Consumer ->>+ Merchant: Check payment status

deactivate Consumer

Merchant ->>+ SwedbankPay: GET <paymentorder.id>

deactivate Merchant

SwedbankPay ->>+ Merchant: rel: paid-paymentorder

deactivate SwedbankPay

opt Get PaymentOrder Details (if paid-paymentorder operation exist)

activate Consumer

deactivate Consumer

Merchant ->>+ SwedbankPay: GET rel: paid-paymentorder

deactivate Merchant

SwedbankPay -->> Merchant: Payment Details

deactivate SwedbankPay

end

end

opt If payment is failed

activate Consumer

Consumer ->> Consumer: Event: OnPaymentFailed

Consumer ->>+ Merchant: Check payment status

deactivate Consumer

Merchant ->>+ SwedbankPay: GET {paymentorder.id}

deactivate Merchant

SwedbankPay -->>+ Merchant: rel: failed-paymentorder

deactivate SwedbankPay

opt Get PaymentOrder Details (if failed-paymentorder operation exist)

activate Consumer

deactivate Consumer

Merchant ->>+ SwedbankPay: GET rel: failed-paymentorder

deactivate Merchant

SwedbankPay -->> Merchant: Payment Details

deactivate SwedbankPay

end

end

activate Merchant

Merchant -->>- Consumer: Show Purchase complete

opt PaymentOrder Callback (if callbackUrls is set)

activate Consumer

deactivate Consumer

SwedbankPay ->> Merchant: POST Payment Callback

end

end

Now that you have completed the Payment Menu integration, you can move on to finalizing the payment in the After Payment section.